eToro com Bitcoin Review 2023 Pros and Cons of eToro

There are literally hundreds of forex brokers offering you their trading services and advice. Add to the mix the couple of hundred websites offering reviews of these same forex brokers and you have a situation whereby a “newbie” doesn’t know where to begin. The certainty of your gains, when they occur, will depend directly on the reliability and honesty of your broker, and its competence. Choosing the right broker is clearly the most important, albeit basic aspect of being a successful forex trader. It is a leading example in terms of safety, company transparency, and client privacy.

eToro Review UK – Is it the Best Broker for 2023? – Business 2 Community

eToro Review UK – Is it the Best Broker for 2023?.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

First of all, eToro is a market maker, so, traders are not dealing with intermarket prices, but trading on eToro’s own pool of liquidity . We’ve also noticed that there’s a 0.5 to 0.6 pip delay on eToro’s quote compared with FX brokers that offer an ECN trading environment. The community provides its wealth of experience and allows especially beginners to trade successfully faster, building on the role models of the popular investors. EToro has not only been a leader in this field for years, but is constantly developing its offer further. Indeed, the successful combination of crypto trading and digital coin management is unique.

Between 2007 and 2013, eToro raised $31.5 million with four funding campaigns, and in December 2014, eToro received $27 million in extra funding, mainly from Russian and Chinese investors. Inactivity fee – There’s also an inactivity fee charged by eToro. For accounts that after 12 months have no activity, a 10 USD monthly inactivity fee will be charged on any remaining available balance. EToro complies with the highest safety standards for client’s funds. For this reason, eToro client’s funds are kept in top-tier international banks, fully segregated from the company’s funds.

The only difference is that CopyPortfolios are thematic investment instruments. They are long-term in nature and are assembled by eToro’s experts. In addition, an optimization is carried out by a machine algorithm of eToro. So account closed, trading stopped and on top of it all a 25 USD charge for refunding. They need to have a calculator that says the fees before i click the withdraw button, at least i know what to expect then.

Best Alternate in Canada for eToro

Additional fees are applied when trading and withdrawing. Placing orders does not incur in any fee, but overnight commissions are charged . There are no fees for the account itself, but believe it or not, there is a 10-USD monthly fee for inactivity, independent from the remaining user account balance.

The rating of eToro’s top traders, who act as popular investors and influence the behavior of their followers, is particularly important here. Trading with financial instruments such as Forex and contracts for difference, which are volatile in themselves, carries a certain risk. The fact that the forwarded blockchain costs, which are included in the eToro wallet transaction fees, are criticized is unjustified, for example. The main concern of the negative eToro wallet experience is to be taken more seriously. Various users note that they expect better access to customer support.

Trading Education

Live chat, although enabled directly from the broker’s website, di not work at the time of writing this review. Withdrawals fees – There is also a standard withdrawal fee of 5 USD , plus the same conversion rate policy applies for withdrawals other than USD. If a trader wants to receive a 1,000 USD withdrawal in EUR, for example, eToro will charge the extra conversion rate of 50 pips. For a complete conversion rate charges of the 8 currencies accepted into USD, please visit the eToro trading fees page.

- Another of the platforms they offer is WebTrader, which is a notable platform generally considered to be reliable.

- With a higher leverage, it is possible to make more profit in the end by making lower bets and deposits.

- The trading platform is offered in more than 20 languages, including English and French.

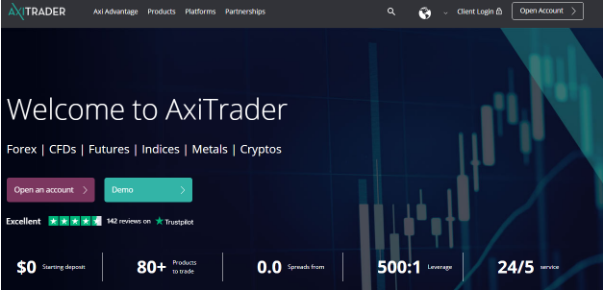

- Trade Forex on floating spreads from 0 pips plus commission on MT4 or MT5.

- Find out how long term investments work and how to use long term investments to build your wealth.

- You should then check your Stop Loss and Take Profit settings.

After you have successfully completed the registration process, you will automatically be logged into your account. Your current account is subject to certain deposit limits as you have not yet verified your identity. This means that the initial deposit limit is 2,000 Euros. In order to use the full functionality of eToro, you need to prove your identity and address as well as a tax number. This process is necessary in connection with the strict requirements of EU legislation and is already an integral part of the secure operation of the platforms on many other exchanges.

IBKR Lite offers you unlimited commission-free trades on stocks and ETFs listed on US exchanges. Unfortunately, IBKR Lite is not available to Canadian residents. EToro is one amongst the best-known forex brokers in Canada these days. It certainly has got to do with the broker’s aggressive marketing.

ECN Forex Brokers

🙌 Join a https://broker-review.org/ of over 14,000 Canadian investors sharing insights and real-time trades, all helping you make your next big move. Compare ECN demo accounts with balances up to US$ 5 million. Test drive platforms and strategies before trading real money. Compare live Forex trading accounts from STP brokers, including DMA and ECN STP brokers, in Canada.

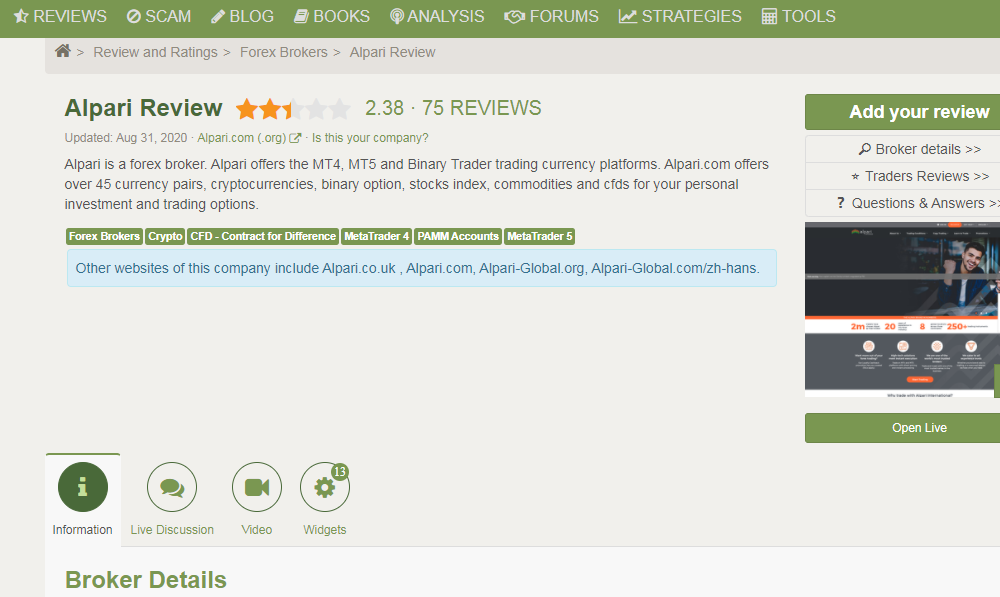

Use the table below to compare platforms, so you can find the right one for you. Finding a good brokerage firm is a key factor in your success as a trader. Many traders are uncertain in this phase of trading as there are many brokerage firms in the market today, but only a few of them prove to work in the best interest of their clients.

In recent years, eToro has enjoyed increasing popularity all over in Europe. Within a very short time, eToro has become one of the leading brokers not only in Europe but also worldwide. He company, which has its official headquarters in Cyprus , is specialized in trading in foreign currencies, equities, indices, ETFs and certificates on commodities. However, eToro has added more and more cryptocurrencies to its portfolio in 2017 and currently offers 15 different cryptocurrencies for trading – as real cryptocurrencies and as CFDs.

By emphasizing ease of use, clean design and a handful of well-curated etoro broker review, eToro helps eliminate all of those problems. The most advertised feature of eToro is its social trading. The platform has built itself heavily around the idea of sharing strategies with other traders in this space. On eToro, you can view the portfolios and trading patterns of other investors to study their choices.

Additionally, OpenBook provides a space for its users to find, share, and discuss trading strategies. OpenBook also has a ranking system for traders whose profiles would be displayed on both OpenBook and eToro’s main page. When creating a trading account with eToro, you would notice that you can have one account that they primarily call the Standard Account. The Standard Account is a secured trading account that would come with three conditions that the client will have to establish.

It went ActivTrades because of the large trading offer and low spreads, it stands out as a test winner. So your working hours may not coincide with that of the support staff, unless it is available throughout the day. You keep a $10,000 position open over night, with no leverage. If you select Markets in the menu, a full range of assets will open up.

The eToro trading platform opens international financial markets to retail traders, allowing trading and investment in stocks, commodities, ETFs, indices, and currencies. This article will examine comparable alternatives for Canadians. The question of the composition of the customer segment is particularly important for a provider of social trading. After all, the number and quality of trades in a community with several million members influences the markets to a certain extent.

You should consider a broker’s security, reliability, availability of your preferred crypto asset, support service, etc. We also advise our readers to review other users’ testimonials to fully understand a broker’s performance and make the best decisions. EToro only has a few trading platforms offered; however, these platforms, like eToro’s own OpenBook, are easy to maneuver for their clients. OpenBook is a platform that focuses on social trading and permits clients to communicate and access various trading communities and investors. The eToro Group was established in Tel Aviv in 2007, initially as RetailFX, from the initiative of brothers Yoni and Ronen Assia and David Ring.

They achieved to make the financial markets accessible to everyone by offering a fully integrated solution . The choice of a good forex trading platform depends on your trading style, subjective aspects such as the feel of the platform interface and the trading features offered by the platform. In general though, the platform should present a comfortable interface with a calm color selection and the more customization options available, the better. To test the software always experiment with a demo account to experience what the platform has to offer.

- The range of further training courses is overall very extensive and differentiated, which is why the broker deserves the sub-rating “good” in the category “Knowledge transfer”.

- I’ve found myself checking the app daily, with its transparent social media feed, real-time notifications, and wealth of information, and as a new and exciting way to meet other Canadian investors.

- The overviews are too small to be able to make good decisions based on the courses.

- The default setting of eToro is that the CSL function is limited to 40% of your total invested copy value.

- Questrade is one of Canada’s top discount brokers, with options for trading on a desktop platform or through a mobile interface.

The credit provider’s final decision is made at their discretion, subject to decisioning criteria. Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. If only they could eliminate the problems with cryptocurrency itself. Trading Commissions – This is when a broker will charge you a percentage based on the volume or value of each trade.

In any case, support should be friendly, fast and competent in their own language to ensure that a broker gets the best possible rating. Brokers such as eToro do not have a banking license and do not hold client funds in custody themselves. A broker’s failure should therefore not result in losses of funds which are not being used as margin in CFD trades. In this case, only a bankruptcy of the account-holding bank could pose a risk. Responsible would be the national deposit insurance of the country in which the account-holding bank is located.